Many of us are unaware of the potential savings a novated lease can provide. When it comes to household budgets, cars can be one of our biggest expenses, so much so that Australians spend 15% of their income on transport costs – almost $385 a week. A novated lease is one way that you might be able to save. We spoke to Wei, team lead at Flare cars, about the benefits of a novated lease and how many Australians are taking advantage of the savings. So if you’re wondering how to save tax in Australia, buckle in.

What is a novated lease?

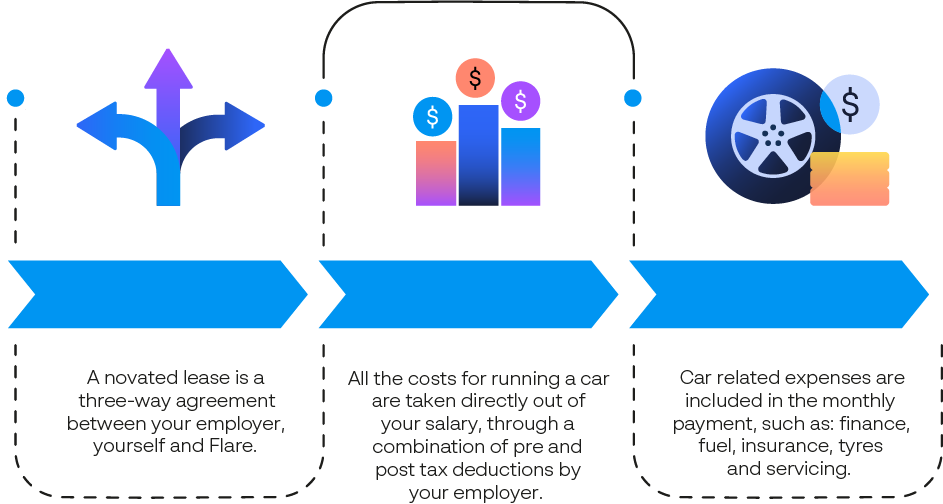

A novated lease is an arrangement between you, your employer and a financier for a period of time, between 1 to 6 years. Your employer makes before-and-after-tax deductions (known as salary sacrificing) to pay for your car and running costs, helping to save money on tax. With a novated lease, your fuel cost is spread across the year and paid out of your before-tax salary to save on running costs.

How the savings work

With a Flare novated lease, you can get the car you want now with no large upfront costs, and bundle up all your vehicle finance and running costs like fuel and maintenance into convenient monthly payments. By doing this, you could make significant savings on the purchase price, your income tax, and GST too.

With a novated lease; your taxable income is reduced, so you could pay less income tax, and less GST on a new or used car from a dealership, and most of your running costs are paid for out of your pre-tax salary. This could save thousands of dollars over the life of a lease.

Let’s look at Sarah, who is looking for a new car to get around her neighbourhood and to and from work every day. Here we breakdown the savings that come from a novated lease, compared to buying the car outright or using a car loan.

Looking to investigate potential ways to save on tax in Australia with your car?

Flare is here to help you kickstart the process. Flare will arrange everything for you – from identifying and sourcing the car at a great price through our network, helping you apply for finance, to buying your car and having it delivered. We’ll also manage the arrangement with you and your employer. It’s that easy.

We have an Australian-based team of car experts dedicated to providing support to our customers. They’re here to save you time and money. All our experts have lengthy experience in the industry and know cars inside and out. They can provide expertise, guidance and step you through the car salary packaging process to find, test-drive and buy the best car for your needs and budget.