Between the third and the last quarter of 2022, the annual inflation rate in Australia climbed from 7.3% to 7.8%. It surpassed market forecasts to become the highest inflation rate since 1990.

Transport saw the biggest increase in price amongst food and housing. With Australians spending 15.1% of their income on transport costs (a staggering $384.86 per week on average), many of them are on the lookout for ways to save on their car running costs.

If you’re one of them, don’t just chase the best deal on a new or used car and wait for cheap fuel days. In this article, we’ll take you through eight ways to save on your car running costs that will make a substantial impact on your budget. At the end, we’ll also show you the one thing you can do to implement all tips at once and compound the savings.

Now buckle up and let’s get started!

Reduce fuel cost

One of the most significant ongoing expenses of owning a car is fuel. There are several ways to reduce your fuel cost:

- Drive more efficiently

By driving more efficiently, you can reduce the amount of fuel you use, make your tyres and brakes last longer and avoid servicing your car earlier than planned. Some tips for driving more efficiently include accelerating slowly, maintaining a steady speed, and avoiding sudden stops or starts. How to remember to do that? Simply imagine your child falling asleep in your car and adjust your driving style so you can enjoy the peace… for a little longer.

- Keep your tyres inflated

It’s important to check and maintain your tyre pressure. Under-inflated tyres create more drag on the road, increasing fuel use. Under-inflated tyres cause erratic wear that results in expensive replacements and an increased chance of blowouts.

- Check your wheel alignment

Every 10,000km, or twice a year (whichever comes first), you should also check your wheel alignment. This will ensure that all of your wheels are working together properly and will increase fuel efficiency, reduce suspension wear and extend the life of your tyres.

Reduce maintenance cost

Regular oil changes, air filter replacements, and tire rotations can all help your car run more efficiently, improve its fuel efficiency and avoid high repair costs. But regular maintenance can also be expensive. So here are some tips to reduce your maintenance costs:

- Follow the recommended maintenance schedule

By following the manufacturer’s recommended maintenance schedule, you can prevent more costly repairs down the road.

- Choose a reliable car

When purchasing a car, choose a reliable make and model that is less likely to require frequent repairs. Sometimes spending a little more in the short term will help you spend less in the long run.

Reduce insurance cost

We all know how frustrating it is to compare insurance policies, premiums and payment options, but shopping around, comparing prices and negotiating with your current provider can save you hundreds of dollars per year. Here are some other things you can do to save on car insurance:

- Pay annually instead of monthly

Many people pay by the month for their insurance policies because it seemed cheaper at the time. But they don’t know that this could cost them hundreds per year.

- Bundle your policy with other products

Many insurance companies offer discounts if you bundle multiple policies, such as car and home insurance.

- Increase your excess

A higher excess can significantly reduce your monthly insurance premiums. If you can afford it, this is certainly an option to consider.

And if you want to discover all the ways you can save on car insurance, you can read this guide from Canstar. There you have it: the 8 ways you can save on your car running cost. Now you can put them into action and rescue your household budget from the high cost of living. Do you want to know how to bundle all those savings into one simple strategy?

Introducing Novated leasing

Novated leasing is an alternative to traditional car ownership that can save you money. With a Novated lease, you essentially “lease” a car through your employer. Your employer deducts some of the lease payments and running costs from your pre-tax salary, which can reduce your taxable income and save you money on income tax.

Here is how, through Flare Novated leasing, you can compound the savings and multiply the benefits:

- Save on tax and car running costs.

By salary packaging your car with our Novated lease, you could enjoy significant tax reductions and GST savings** on your car purchase, fuel, tyres, servicing and maintenance. - Get the car you want, now.

We’ll help you get into your new car quickly by sourcing your vehicle, organising a test-drive, helping you buy it, and arranging the delivery. So you can secure the car you want today. - Get better vehicle pricing.

Why not benefit from Flare’s buying power? Our team of car experts does the hard work to negotiate on your behalf and secure great deals in our fleet network for both new and used cars. - Tax benefits.

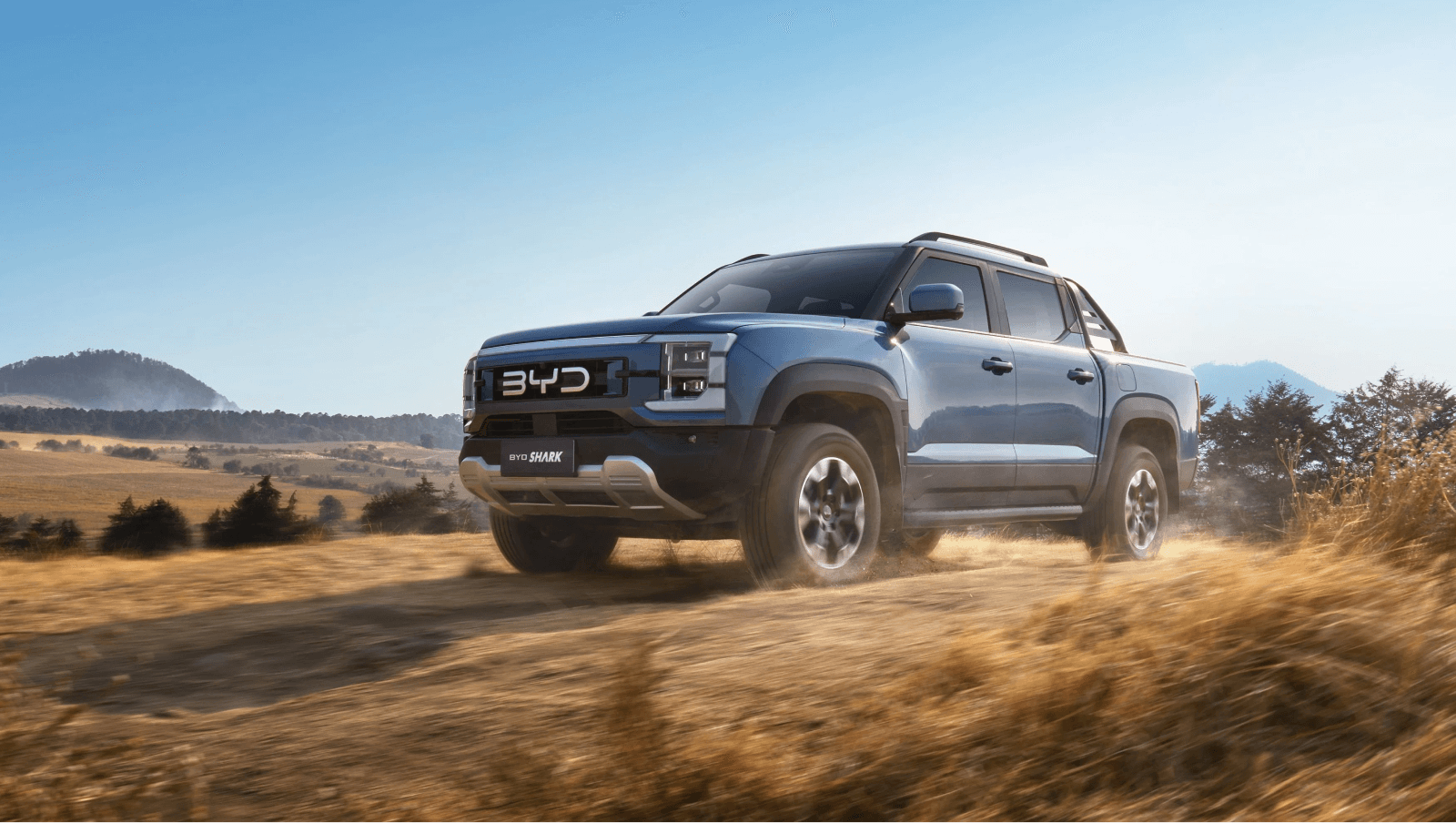

You can take advantage of the tax benefits, such as income tax savings and reduced GST costs. Some of the lease payments are taken out of your pre-tax income, which means you could afford a more expensive car than you would with traditional financing. - More efficient vehicles.

You can save by choosing a cheaper-to-run vehicle, such as a fuel-efficient car, an Electric Vehicle or a plug-hybrid vehicle. With the recently introduced legislation, EVs with an RRP under $89,332 are exempt from the 47% fringe benefits tax if provided through a novated lease. This could save you $9,000 per year on average compared to an Internal Combustion Engine vehicle with a Novated lease. - Lease a new, used or existing car.

With a Novated lease, you aren’t limited to a new car, but can get almost any car of choice, new or used, as long as it is considered a car for fringe benefits purposes.* You can even lease your existing car if it is less than 12 years old at the end of the lease.

Novated leasing is easy and convenient with Flare. Our fully digital Novated lease process is completely paperless from start to finish, making it simpler, faster, and better for you and the environment. A Flare cars concierge manages every step of the process, sourcing your vehicle, organising a test-drive, helping you buy it, and arranging the delivery.

*For fringe benefits tax (FBT) purposes, a car is any of the following: a sedan or station wagon, any other goods-carrying vehicle with a carrying capacity of less than one tonne, such as a panel van or utility (including four-wheel drive vehicles) and/or any other passenger-carrying vehicle designed to carry fewer than nine passengers.

**If you purchase a car and the price exceeds the car limit, the maximum GST credit you can claim (except in certain circumstances) is one eleventh of the car limit, which is $5,885 in 2022-23.