A lack of financial wellbeing is costing Australian businesses an estimated $31.1 billion in lost revenue every year. But more importantly, it’s negatively impacting the overall health of employees, who are having to take more sick days and struggling to be productive at work as a result of their financial stress.

What can HR teams do to support workers who are having trouble with their finances? Clearly, simply providing employees with a paycheck isn’t enough. In this post, we’ll explore additional ideas to help your workforce achieve better financial health.

How HR can support employee financial wellbeing

While paying employees a fair salary is an important part of financial wellbeing, there are other components to take into consideration. For instance, even if an employee makes a high salary, a lack of basic money management skills won’t set them up for success in the future.

That’s why HR needs to find other ways to advocate for the financial wellbeing of their employees – outside of their salary. We encourage HR leaders to work closely with their C-suite and finance teams to support initiatives that can set employees up for success – not only in the present – but also in the future. We share recommendations in the next section.

Ideas to help employees with financial wellbeing

There are many modern solutions to choose from when it comes to helping employees with their financial wellbeing. We share some of our favorite ideas below:

1. Encourage savings

Whether it’s to their superannuation account or a separate retirement account, it’s important to encourage your employees to put aside as much money as possible. There are a few ways to motivate employees to save. One of the most effective ways is to set up a system that allows workers to automatically take a portion of their paycheck and deposit it into their savings accounts. This way, your employees don’t have to make the challenging decision to manually take money out of their paycheck – it just goes into their savings without them noticing and will accumulate over time.

The benefits:

- Sets employees up for success in the future

- Allows employees to save for major milestones, such as purchasing a house or starting a family

- Serves as a financial safety net in case of emergency

2. Provide flexible payment options

More and more employers are opting for flexible payment options for their employees. It’s easy to see why. Flexible pay is a great option for employees who want to access their paychecks on their own time instead of following the standard payroll schedule. So instead of receiving a paycheck every two weeks, an employee can choose to cash out what they earned in real time.

The benefits:

- Allows employees to choose a compensation schedule that works for their needs

- Relieves the stress of having to worry about whether they’ll receive a paycheck in time to pay rent or cover their next bill

3. Support major expenses

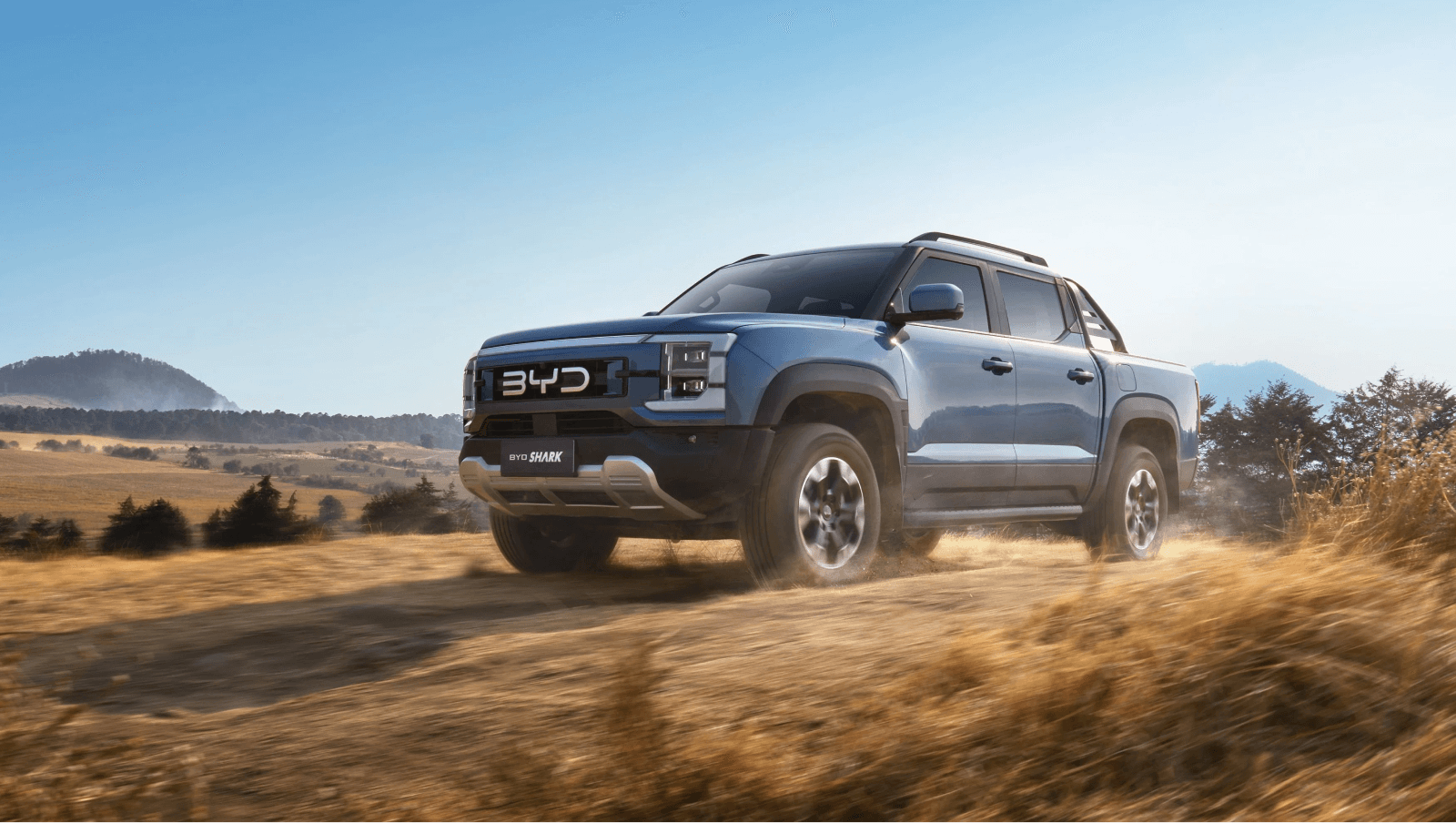

Many times, what prevents employees from experiencing better financial wellbeing is the major recurring expenses in their lives. For example, monthly car payments. Having to budget for the mortgage – on top of taxes, gas, and maintenance costs – for several years can be financially burdensome. To relieve the stress of this expense, your company can either offer company car loans or set up a novated lease that allows employees to finance a new or used car with payments out of their salary package with pre-tax deductions.

The benefits:

- Makes major expenses more manageable and easier to budget for

- Saves employees money in the long run

- Doesn’t require a long-term commitment and offers more flexibility in terms of options

4. Create financial education opportunities

A lack of financial literacy is a huge blocker when it comes to employees achieving financial wellbeing. In fact, a survey found that fewer than half of all Australians could answer five basic financial questions correctly. To improve financial literacy, we recommend introducing various educational opportunities for your workforce. This can include anything from hosting financial literacy workshops to offering free sessions with financial advisors as a company benefit.

The benefits:

- Empowers employees to take their finances into their own hands

- Arms employees with the knowledge to make smart financial decisions

There are many things HR teams can do to improve the financial wellbeing of their workforce – even beyond just paying a salary. Identify which of these recommendations align with the needs of your organisation and get started on them today.

If you have any employees who are in need of support, be sure to check out Wellness@Work, a free hub designed to support HR and Australian workers by giving them access to free content.

If you’re looking for an additional HR software to support your business, Flare offers a free onboarding software with employee management and benefits. To learn more, please request a demo.