In a move that supports both the environment and the budget of Australians, the federal government has recently introduced legislation that makes electric vehicles (EVs) priced under $91,387 exempt from fringe benefits tax (FBT).

This legislation is part of a wider initiative to decarbonise Australia, and it will directly benefit you as an employee. If you’re wondering how, you’ve come to the right place.

This article has everything you need to know about FBT: what the tax is, how you can benefit from the recently introduced exemption, what options are available to you and how much you can save. We’ve also included a handy comparison table.

But let’s start from the beginning…

What’s the Fringe Benefit Tax?

Fringe benefits are extra perks offered to employees in addition to their salary. These benefits are offered as part of their salary package to either compensate for work-related costs, or make the position more attractive or the job more rewarding.

Fringe benefits often offered to employees can include:

- Novated car leases

- Discounted loans

- Gym memberships

- Use of company cars for private purposes

- Free tickets to concerts

- Reimbursements for expenses such as childcare fees

Packaging a car via novated leasing is one of the most common fringe benefits in Australia.

A novated lease is a three-way contract between the employee, the employer and a salary packaging (also known as salary sacrifice) provider, who also arranges the finance. A novated lease usually spans one to five years, and at the end of the contract, you can either extend the lease for the same vehicle or start a new lease, upgrading to a new car.

All the above perks are subject to Fringe Benefits Tax, as regulated by the ATO.

The tax was introduced in the mid-1980s in an attempt to control the increase of salary packaging. As a recruitment strategy, organisations began to bundle cars, private health care, gym memberships and more into an attractive salary package. This, in turn, deprived the government of income tax revenue.

A few handy things to note:

- FBT applies even if the benefit is provided by a third party

- FBT is separate to income tax and calculated on the taxable value of the fringe benefit

- Employers might claim an income tax deduction for the cost associated with providing fringe benefits and for the FBT amount itself.

There’s plenty more information on FBT via the ATO Government website and the Business Government site.

Let’s talk FBT exemption for EVs

As of November, new EVs and PHEVs purchased after July 1st, 2022 and priced under the luxury car limit of $91,387 are exempt from FBT. This tax exemption gives employees the opportunity to salary package an EV from their employer to enjoy a sizable tax benefit.

Here’s a few things to note:

- To be eligible for the exemption, the car must be classified as zero or low emissions, i.e. battery electric vehicles, hydrogen fuel cell electric vehicles and plug-in hybrid electric vehicles

- The bill applies to fringe benefits on an eligible vehicle that is first held and used on or after 1 July 2022

- The EV must be priced under $91,387, the luxury car tax threshold

- If the EV was purchased before 30 June 2022 but wasn’t delivered by this date, it might still be eligible for the exemption

- The FBT exemption can also apply to second-hand electric cars.

Before this bill was passed, you would have expected to pay 20% of the FBT base value of the vehicle as a post tax deduction from your salary. Now, with this change, the total amount is calculated and deducted before-tax so you, as the employee, is not paying any FBT or income tax on your new eligible EV or PHEV

In a nutshell, if the EV price is under $91,387, you can get that vehicle on a novated lease completely tax-free!

Plus, your employer can claim GST on most of your associated running costs. Win-win.

How much would you save?

Let’s do the maths.

The government has projected potential savings of $4,700 for employees based on a $50,000 EV.

This means that EVs are becoming drastically more affordable. In fact, a $73,000 EV could cost about the same after-tax as a $53,000 petrol car, when purchased via a novated lease.

Purchasing your next electric car via a novated lease could see you enjoying a huge tax saving while contributing to the improvement of Australia’s environment.

The best part is, with this new scheme, you could lease a brand new Tesla Model 3 for the same price as a petrol-run Mazda 3!

Don’t forget EVs are also generally more affordable to run because you remove the cost of fuel.

With a Flare novated lease, you can reap the benefits of the new FBT exemption law, get access to a full-service concierge, and the opportunity to design a tailored lease program that fits with the way you work and live.

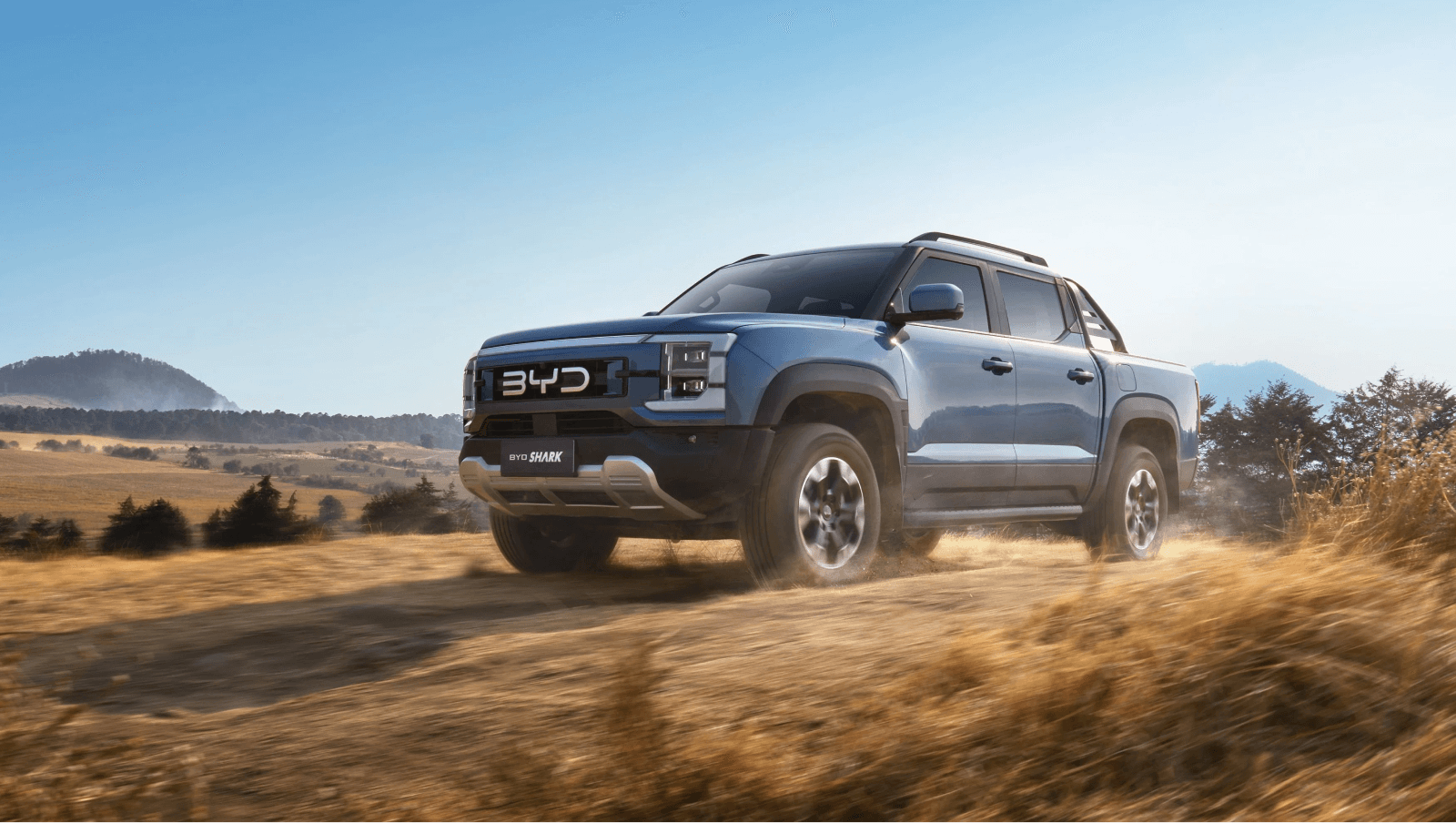

Not sure where to start? Have a look at the list of the top 10 EVs that qualify for FBT exemption in Australia

Did you know that with a Flare EV Novated Lease you get:

- The car you want, now. No deposit is required for a novated lease, just a refundable order fee, so you can secure the EV you want today.

- Save on tax and running costs. Enjoy significant tax savings and less GST on your car purchase, electricity mileage, servicing, and maintenance.

- Easy budget management. Avoid hidden expenses and spread your bills throughout the year by bundling up your finance and running costs like electricity mileage, servicing, maintenance, and rego into one convenient monthly payment.

- Everything’s included. You benefit from before-tax savings on all the running costs of your vehicle, so you have nothing left to worry about.

Flare is the leading expert in electric vehicles. We can help you get behind the wheel of your dream car today. Our novated lease experts will work with you to find the right EV for your needs and lifestyle, plus show you how to save thousands. Let our expertise and experience make your dream of driving an electric vehicle a reality.

2 Monthly running costs include fuel, maintenance, insurance and servicing.

3 The residual cost for this model comes to $27,845, based on a balloon payment of 37.5%

The above comparison is indicative and of a general nature only, and we have not taken your personal financial objectives, situation or needs into account. We recommend you consider if you need to seek professional financial advice before making any financial decisions regarding Flare Cars.

All calculations are based on the following assumptions: living in NSW, salary: $95,000 gross p.a., travelling 15,00 kms p.a., finance/lease term: 48 months. Figure quoted include budgets for finance, fuel, servicing, tyres, maintenance, comprehensive insurance, registration and CTP.

Novated lease calculations use net GST processing method and Employee Contribution Method for FBT purposes; the total cost over life reflects the net effect after tax and includes a Flare cars admin fee; Interest rate quoted for both the novated lease and car loan calculations is 9.5% with a $550 inc GST establishment fee. Comprehensive Insurance estimate based on 2.5% of the purchase price of the car.